Like many other New York State programs, Healthy New York aims to offer services for the most vulnerable, susceptible, and disenfranchised citizens of the state. It is a state-sponsored health insurance program uniquely designed to offer cheap, affordable coverage to those most exposed to what is known as the “health insurance gap”. In layman’s terms, this gap refers to those who earn too much income for Medicaid benefits but do not earn enough to afford private coverage.

While this particular demographic may not be covered, it does not mean that their medical costs are shielded from the industry. In fact, these costs seep into the system through holes that actually exacerbate the continuous increases in health care expenditures. This typically happens through lack of access or health illiteracy. Let’s take a look at some examples of exactly how:

- A lack of a primary care doctor leads people to incur unnecessary visits to the emergency room where health care costs are exponentially higher

- Not completing proper rehabilitation

- Failure to adhere to medication instructions due to complexity or price

Accumulating over half a million enrollees throughout its 12-year lifespan, Healthy NY aims to solve these issues through three main strategies: eligibility rules, plan design, and a reinsurance program. By definition, Healthy NY operates much like a health exchange. Commercial health carriers compete for business through the state-sponsored program that commoditizes health insurance by regulating its benefits, approving its pricing, controlling distribution channels, and providing stringent transparency to an industry that typically undermines free market principles. It is a deviation of what AC Enthoven calls Managed Competition.

Unlike other states entering into the exchange, New York has the unique opportunity to learn from the pros and cons of the aforementioned strategies. Let’s take a look at what the health executives should be analyzing.

Eligibility Rules

Pros: Healthy NY insures those who could not otherwise afford it. As a result, the rules surrounding eligibility are airtight. To be eligible, the applicant cannot have been covered any time in the prior 12 months. This rule can only be overlooked if a person experiences a special event in their life, such as having a child, marriage, moving, or losing coverage from somewhere else. An individual’s income must fall below 250% FPL, or 400% FPL for employees of a small business. Employees of a business that does offer insurance but does not contribute toward the cost of the coverage, a typical experience for many part-time workers, can also enroll in the program.

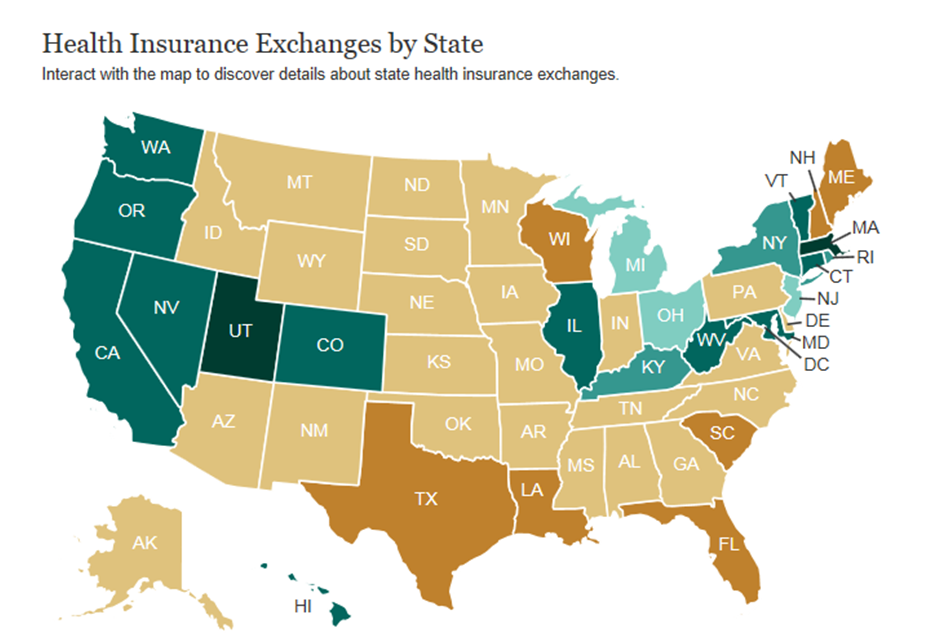

Cons: The eligibility rules for the most part are very similar for every county in the state. This can prove to be problematic due to the variability of demographics for a state with over 19 million people. Regionally areas like Buffalo and Rochester should have the flexibility to build eligibility rules that meet the needs of those communities. Conversely, urban and dense areas like Brooklyn or Manhattan where it is less homogeneous require attention to the nuances of those communities and flexibility to alter certain rules. In a similar fashion, health care reform is a one size fits all approach to 50 different states. 40% of the national uninsured population resides in 4 states (CA, NY, FL, TX) yet health care reform disrupts all states. Similarly, 75% of the uninsured population in New York resides in the downstate region (New York City & Long Island). A program to solve the uninsured should be national in support but very local in execution.

Plan Design

Pros: Healthy NY offers comprehensive coverage for the most typical health services that patients incur. This includes primary care and specialist office visits, inpatient hospital stays, preventive care, and pharmacy benefits. Co-payments for these services are more affordable than the average commercial health plan. Many plans created for lower income individuals fail to realize the high sensitivity to price and prohibit cost sharing for routine visits. This can actually result in a counterintuitive effect of consumers foregoing coverage due to high costs. Additionally, Healthy NY does not offer out-of-network benefits, which helps to keep costs low, protect the consumer from balance billing, and protect the industry as a whole from inflated health hikes.

As of 2010, the program helped to insure over 165,000 New Yorkers who would have otherwise been trapped in the “gap”.

Cons: The benefits covered under Healthy NY are not quite as extensive as those covered under Obama’s health care reform legislation. A big one is ambulance services; with Healthy NY, a member would face inpatient hospitalization co-payments of $500 and be 100% responsible for the ambulance charge (out of pocket). In 2006, the Pataki Administration issued an opinion to a New York State law providing some patient protections in an attempt to shield members from these costs. However, the outlined patient protections do not help individuals without ambulance coverage. And it’s not like ambulance costs are decreasing either! Earlier this year, the FDNY requested a 40% increase in ambulance services that would increase charges from $515 to $704. So in actuality, a Healthy NY inpatient visit could end up close to $1,200 in an actual emergency situation. If the member has not yet met their deductible, those charges could wind up being paid for entirely out of pocket. An interesting side note to this is that over 34% of FDNY’s ambulance bills go unpaid, representing close to $130 million annually.

Other services not covered by Healthy NY include mental health, alcohol and substance abuse, hospice care, and dental/ vision/ hearing aid benefits. On average, Healthy NY members with mental health conditions pay over $300 a month for coverage with zero insurance contributions.

Cutting benefits for the sake of affordability has proven to reduce health care costs in the short term but not necessarily bend the long term cost curve. Despite this affirmation, a $1,200 deductible for individuals (and $2,400 for families) is currently in the plan design for 2012 enrollees. That represents 9% of the annual income for someone who is right at the cusp of being ineligible for Medicaid and 5% of the income for someone at the highest income level for Healthy NY eligibility (250% FPL). So while claims data may show health care utilization in high deductible plans to be lower than in first dollar coverage plans, Health NY history has shown that longer-term impacts could cause more harm and actually result in higher overall costs and a sicker population.

Reinsurance Program

Pros: The State of New York realized from the beginning that the only way to make this product appropriately affordable is through a reinsurance program. Specifically, the State pays 90% of all medical claims between $5,000 and $75,000. This has allowed for more affordable rates for New Yorkers as well as favorable financial results for the participating health companies. In 2009, participating health companies ran at an average 20% operating loss without reinsurance. This means that they paid out 20% more to doctors and hospitals than they were able to collect in premiums. However, the reinsurance program quickly turned this average into a 17% operating gain.

Cons: Like all other forms of State funding, reinsurance funding is susceptible to budget cuts and politicization. This, in turn, produces uncertainty for the participating health companies. In 2010, New York only paid out $160 million of the $180 million requested reimbursements. The underfunding represented 12% of the total claim costs between the identified thresholds. It is also important to note that reinsurance occurs after the health care calendar year cycle. So, this means that there is a period of time when a health company could lose on a monthly basis, until finally the reinsurance payment is made.

Additionally, when these cuts do occur, it forces health companies to make up the difference in future rate increases. This directly conflicts with the “spirit” of the program. As costs increase, more Healthy NY members are liable to drop coverage all together and remain uninsured. Finally, the reinsurance program has not done so well in regards to member satisfaction. A 2010 survey conducted by Burns & Associates showed that only 47% of sole proprietors/ individuals were very or somewhat satisfied with the cost of the Healthy NY program. In fact, complaints about costs/ rate increases were made publicly available by the Department of Financial Services. Check out the comments here.

Lastly, reinsurance based on claim costs that have not been adjusted for inflection fails to stay current with the near double digit increase in health care costs each year. New York in particular is one of the most expensive states for health care services. The Risk adjustment program in Obama’s health care reform bill will use diagnosis codes rather than claim dollars which will be an adjustment for the New York health care industry; especially if reimbursements are based on national averages rather than encompassing region differences in pricing.

Unlearned Lessons

At the end of the day, health care exchange attempts to solve the uninsured crisis through plan designs, eligibility, and reinsurance schemes. The plan designs help to provide lower co-payments/ deductibles for individuals with less income. The eligibility requirements carve out individuals receiving insurance from their employer, making sure affordability and benefit requirements are met. And lastly, behind-the-scenes actuarial programs attempt to mitigate chance and solve for market failures through risk adjustment and reinsurance. In some ways, New York is serving as a guinea pig to many of the untested provision of the Affordable Care Act. It will be interesting to see how many of the lessons learned from Healthy NY will continue to go in one ear of the industry and out the other.