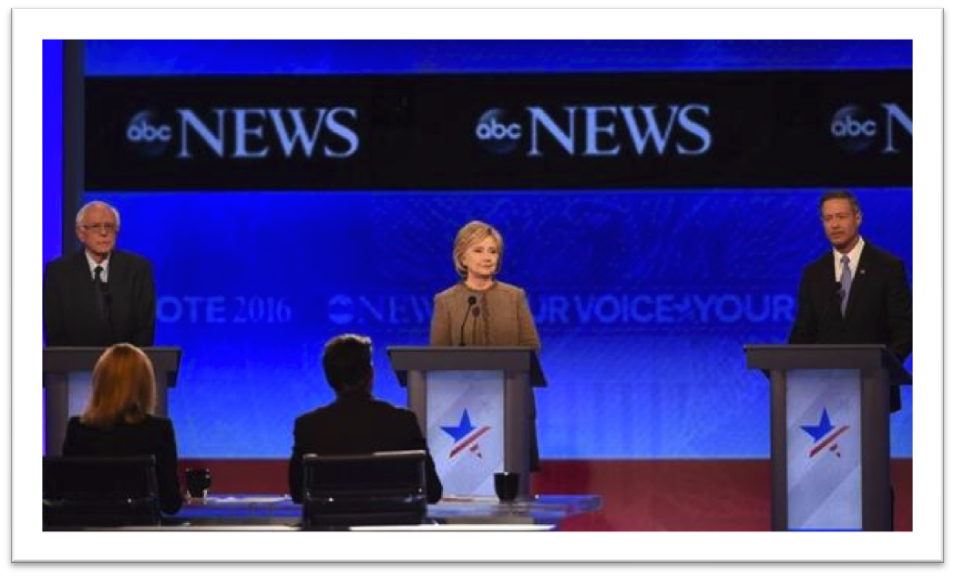

Last night, roughly 6.7 million Americans viewed the Democratic Debates held in New Hampshire; the home of the 1st Democratic primacy scheduled for Feb 9, 2016.

Most of the debate was consumed by topics on national security, the economy, and Donald Trump even though 29 million Americans still lack health care coverage.

However, near the end Clinton, Sanders, and O’Malley finally had an opportunity to share their views on healthcare for roughly 2 1/2 minutes:

What We Knew Already?

- Healthcare represents 1/5th of our Gross Domestic Product (GDP)

- 12 million Americans have gotten health insurance through the Affordable Care Act from the Health Insurance Marketplaces

- There are 29 million Americans that still lack insurance coverage

- Health plans on the Health Insurance Marketplaces have seen double-digit rate increases since 2014.

- Healthcare deductibles have risen 65% over the past 5 years

- Half of the CO-OPs created by the Affordable Care Act to compete with health insurance companies have gone out of business despite receiving start-up loans from the Federal Government.

What We Know Now After Tonight

Hillary Clinton: HillaryCare

- Believes Healthcare is a basic human right.

- Intends to “defend & extend” the Affordable Care Act and protect it from politicians that wish to repeal it.

- Pointed out the growing prescription drug costs and wants the Center of Medicaid and Medicare (CMS) to use their buying power to negotiate with drug companies to lower costs.

- Acknowledged the growing deductibles and out of pocket costs and calls for programs to lower them to a more manageable level.

- Plans to continue federal funding to Planned Parenthood and non-profits like them.

- Calls for more oversight on health insurance companies despite the hundreds of new rules that are now in place due to the passing of the Affordable Care Act.

Bernie Sanders: BernieCare

- Believes the Affordable Care Act did not go far enough to cut healthcare costs and increase the number of Americans with healthcare coverage.

- Believes in “Universal Healthcare” noting that the United State is one of the only industrialized nations in the world that does not give health coverage to all of its citizens.

- Wants to extend Medicaid and Medicare programs to all Americans.

- Believes in a “Single Payer” system that would allow the United States to negotiate prices with drug companies and hospitals. The program would create the American Health Security Trust Fund and be funded by tax credits and ‘cost sharing reduction’ funds provided in the Affordable Care Act and other government programs.

Martin O’Malley: MartinCare

- Believes “every American deserves the opportunity to live a healthy life”.

- Will build on the progress of the Affordable Care Act focusing on reduced costs, more access to physicians and hospitals, and higher quality care.

- Touts successes in Maryland’s 2014 healthcare rankings, which showed the most improvement than any other state in America.

- Will expand upon the payment reforms made in Maryland that removed the financial incentive of hospital payments based on “volume” to a Volume Adjustment System where payments are based on “value”.

- While results are still pending, a January 2014 Health Affairs article stated that “the Maryland Model can serve as a template or as a springboard to creative efforts by other states to address an economically dominant provider industry and ever-rising health expenditures.“

- Believes in Medical Homes that increase healthcare quality and cut costs by grouping together different doctors under one rook and allowing them to share medical data.

- Wants to remove the confusion in Healthcare bills and increase legislation around anti-trust laws to prevent expensive prescription drugs.

What’s The Future?

All three candidates intend on building on the successes of the Affordable Care Act. There is definitely still more work to be done since based on a Kaiser Health Tracking poll 46% of Americans still have an unfavorable view of Healthcare reform:

- Republicans: 14% Favorable / 79% Unfavorable

- Democrats: 67% Favorable / 19% Unfavorable

- Independents: 32% Favorable / 53% Unfavorable

Source: Kaiser Health Tracking Poll: The Public’s View on the ACA.

Question asked: “As you may know, a health reform bill was signed into law in 2010. Given what you know about the health reform law, do you have a generally favorable or generally unfavorable opinion of it?