The non-partisan Congressional Budget Office (CBO) “scored” the American Healthcare Act this yesterday. That means they have forecasted the impacts of the legislation to the Federal budget over the next 10 years.

For context, when Lyndon Johnson signed Medicare into law the CBO did not yet exist. Back then, all cost estimates and projections were delivered solely from White House. It was not until 1974, when a Republican President by the name of Richard Nixon signed the Congressional Budget and Impoundment Control Act into law, that the CBO was established. The aim of the CBO is to provide “objective, nonpartisan, and timely analysis that aids in the economic and budgetary decisions on a wide array of programs covered by the federal budget.

Here is the CBO report on the American Healthcare Act

American Healthcare Act: Fewer Enrolled = Huge Savings

The American Healthcare Act is projected to reduce federal deficits by $337 Billion by 2026.The reductions are a culmination of $1.2 trillion decrease in spending, partially offset by $883B reduction in revenues. But at what costs?

The largest impacts to the budget are those that impact insurance coverage. With 24M fewer Americans covered, Federal deficits are projected to decline by $935 billion over a 10 period.

What makes up the $935B in reductions?

Medicaid:

- Revenue: $880B in savings from undoing Medicaid expansion in future years and converting Medicaid to per capita caps with a ceiling on yearly price increases.

- Enrollment: 14 million people would lose their Medicaid coverage by 2026

Individual Market:

- Revenue: $673B in savings from removing the individual mandate and shrinking the funding available for financial assistance. However, the bill implements a new form of tax credits based on age which offsets the savings by $361B in costs.

- Enrollment: 9M people would lose their coverage by 2020, but that would begin to improve to shrinkage of only 2M people.

Employer Market:

- Revenue: Penalties for Employers and Individuals offsets savings by $209B

- Enrollment: 8M people would lose coverage from their employer coverage with the removal of the employer mandate.

Miscellaneous:

- Revenue: $33B in deficit savings from the following items:

- Funding to provide the states with funds to keep the insurance markets stable offset savings by $80B.

- Additional funding to Medicare offsets savings by $43B.

- Lastly, tax credits for COBRA and changes to tax revenue on compensation increase deficit savings by an additional $70B

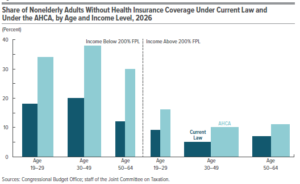

- Enrollment: 24M people already do not have insurance under the ACA. This new law would increase that by an additional 28M people to equal 52M uninsured by 2026 based on CBO estimates; 16% of the population. Ironically, this was the uninsured rate prior to the ACA legislation.

The new healthcare law allows the following things:

- Health plans charging older individuals 5x more than younger/healthier ones.

- Health plans offering plans that cover less than 60% of someone’s average healthcare costs.

- Financial assistance to be based on age instead of income.

- Americans to no longer face penalties for forgoing health insurance and large employers no longer face penalties for not offering health insurance to their employees.

- The removal of people who gained Medicaid coverage from the ACA expansion after 2020.

Meet John & Jeff: A real life example

John – 21 year old than earns 26,500 per year

- Current Law: John can buy a plan that covers 87% of his healthcare costs (Gold Plan) for $5,100 per year ($425/month) on the Health Exchange. At 175% of the federal poverty level, he would receive $3,400/yr in financial assistance through subsidies ($283/month). John would owe the health plan $1,700/yr. ($141/month).

- New Law: John can buy a plan that only covers 65% of his healthcare costs (Bronze Plan) for a much lower price, $3,900 per year ($325/month) on the Health Exchange. His tax credit is now based on age, and at his age he would receive $2,450/yr in financial assistance ($204/month). John would owe the health plan $1,450/yr. ($120/month). He saves $252 a year for a plan that covers 22% less in his average healthcare costs (ie: higher deductibles). But he may have an HSA he can use to fund his deductibles to pay for healthcare costs with tax free money.

Jeff – 64 year old than earns 26,500 per year

- Current Law: Jeff can buy a plan that covers 87% of his healthcare costs (Gold Plan) for $15,300 per year (1,275/month) on the Health Exchange. It is more expensive because today health plans can charge 3x more for older individuals. However, at 175% of the federal poverty level, he would receive $13,600/yr in financial assistance through subsidies ($2,408/month). Jeff would owe the health plan the same amount as John, $1,700/yr. ($141/month) because subsidies are currently ased on income.

- New Law: Jeff can buy a plan that only covers 65% of his healthcare costs (Bronze Plan) for a much higher price, $19,500 per year (1,625/month) on the Health Exchange. It is even more expensive now because the new law permits health plans to charge older consumers 5x more than their younger consumers. However, his tax credit is now based on age, and he would only receive $4,900/yr in financial assistance ($408/month). John would owe the health plan $14,600/yr. ($1,216/month). Jeff would pay $12,900 more per year for a plan that covers 22% less in (ie: higher deductibles). But again, he may have an HSA he can use to fund his deductibles and pay for healthcare costs with tax free funds.